Forget all about sending Excel templates back-and-forth! This month, we are releasing a new Balance Sheet on GrowthWheel Online, that will help you and your clients get a quick overview of the company’s distribution of assets and liabilities.

The Balance Sheet is the latest add-on to the Business Profile, where you can already enter financial information like revenue, profit, employee count, and funds.

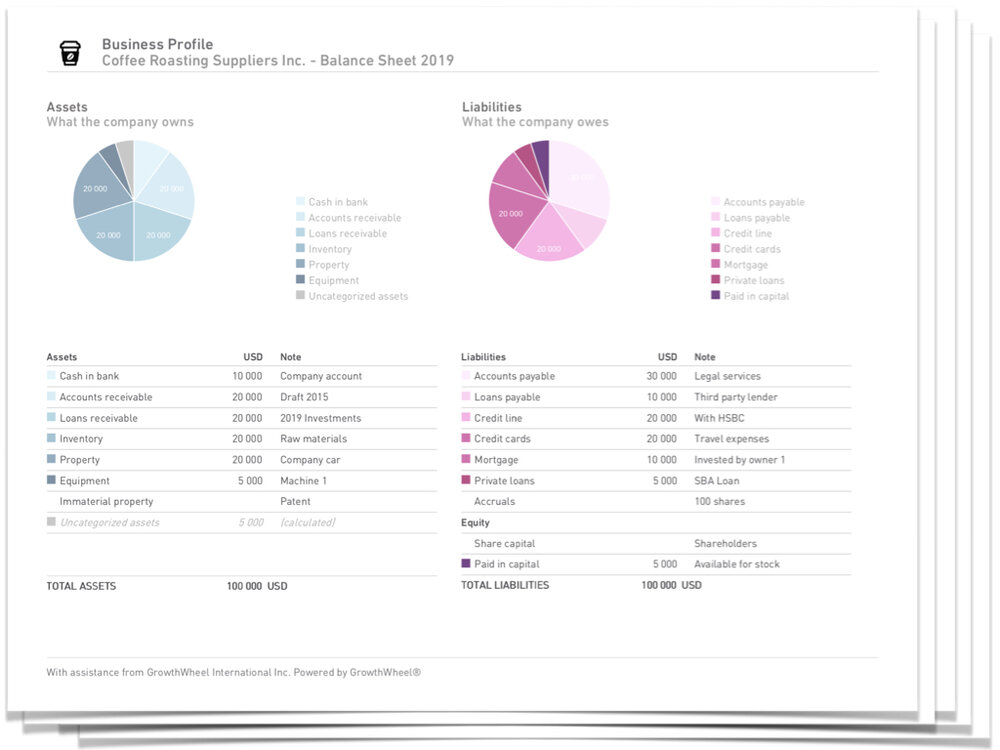

Even clients who lack fluency in accounting can easily pick and choose from pre-made assets like “cash in bank”, “inventory, and “prepaid expenses” and enter the amounts. Or they can add liabilities like “mortgage”, “private loans”, and “credit cards”.

The chart will immediately show the distribution of the client’s assets and liabilities, and the table will show the totals.

The Balance Sheet is 'smart' in the way that “total assets” will always be equal to “total liabilities”. When an asset is added, an uncategorized liability will automatically be added to make the balance sheet stabilize until a liability is added to provide a specification.

This is just the first release of the Balance Sheet — in a few weeks we are releasing even more features!

Below you can get an introduction to the Balance Sheet by David Madie, GrowthWheel Founder and CEO.

The Balance Sheet

—get a quick overview of your client’s assets and liabilities

As always, the Balance Sheet can be printed as a visual one-pager, or as a part of the entire Business Profile, so it’s easy to share with stakeholders or bring along to the bank.